DAD LIFE

OUR COLLEGE SAVINGS GOALS FOR OUR KIDS – AND WHY NOW IS A GREAT TIME TO GET STARTED

This is a sponsored post. All opinions are my own.

Our lives have changed in ways I never would have imagined a year ago. As our kids have been exposed to new experiences and ideas, they’ve grown and matured. I’m starting to see glimpses of what they might do as adults.

Alice wants to be a writer. Simon wants to be a professional gamer. And Miles wants to wear camouflage and be in the woods as much as possible. I’m sure there’s a profession in there somewhere.

Which is why my wife and I are continuing to support our kids by contributing to their Ohio 529 college savings plan every month. And it’s why I’m teaming up with Ohio 529 in advance of 529 day on May 29th to share more information so that you can do the same.

The flexibility and tax advantages of this plan give us confidence that we will be able to support them financially in their academic expeditions. And if Alice decides to go into business or if Simon doesn’t make it as a full time gamer or if Miles gets lost in the woods, I feel better knowing that they always have a back up plan.

To be clear, it is not our goal to fully fund a 4-year college program for any of our kids. Anna and I were blessed to have parents support us as much as they could – while we also worked in college and came out of school with a few student loans. This balance of having the majority of college paid for while still having to work and make student loan payments after college feels like a reasonable scenario for our kids.

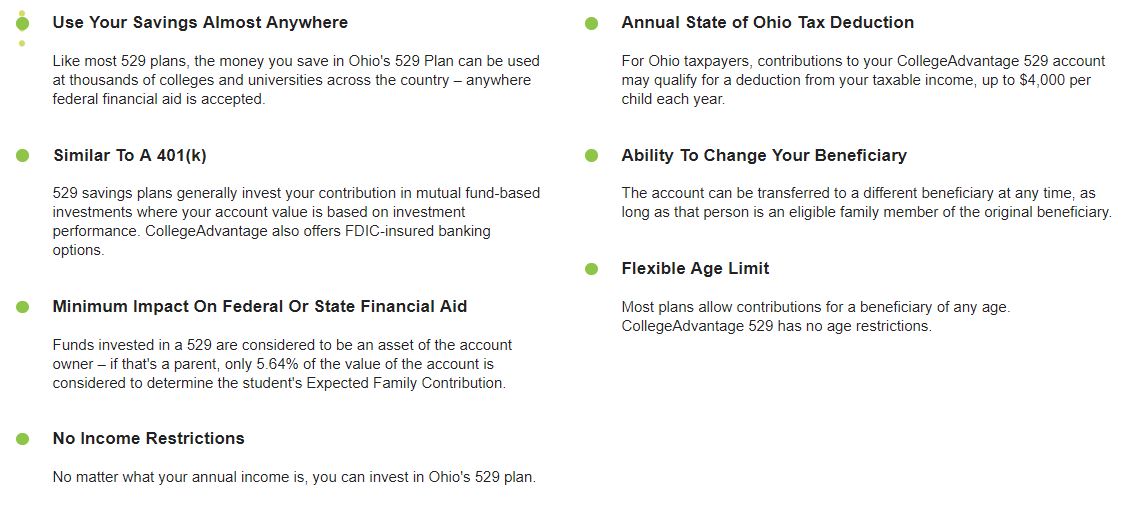

Whether you’re hoping to pay for 100% of your kids’ higher education or just a portion of it, an Ohio 529 plan allows you to take advantage of higher rates of return (long term vs. traditional savings accounts) and get the benefits of your withdrawals being tax free when used for education expenses.

Ohio 529 funds can be used for schools outside of Ohio as well as programs outside of traditional 4-year colleges.

If you’re new to the college savings process, there are a few tools on the Ohio 529 website that can help you plan for your financial future.

COLLEGE SAVINGS PLANNER

This planner allows you to look at your college savings goals and projected costs and estimate what you’d need to save each month in order to meet your goals.

COST OF WAITING CALCULATOR

This calculator lets you key in the age of your child, how much you want to start contributing each month, and it will show you how much you’ll need to save each month in order to meet your college fund goals. By adjusting the age of your child, you can see how much more you’ll need to set aside each month by waiting even one year. Did you know that waiting until the age of 5 to start contributing increases the monthly contribution needed by almost 70% to catch up?

OHIO’S 529 BLOG and WEBSITE

The Ohio 529 website and blog is regularly updated with information to help you continue adjusting your savings plans to best optimize your investment. Take this quiz to test your own 529 knowledge!

INTERESTED IN HEARING WHAT MY WIFE HAS TO SAY ABOUT SAVING FOR COLLEGE?

You must be logged in to post a comment Login